Instead, they are treated as period costs, as office rent or insurance would be. Various types of direct materials that are consumed in different manufacturing industries usually come from natural deposits, agricultural fields, forests and animals etc. However, the situations are not uncommon where the output of one business is further processed by another business to create a final and useable product.

The accounting department.

- If the standard quantity allowed had exceeded the quantity actually used, the materials usage variance would have been favorable.

- As direct materials, direct labor, and overhead are introduced into the production process, they become part of the work in process inventory value.

- Favorable rate variances, on the other hand, could be caused by using less-skilled, cheaper labor in the production process.

- When jobs are billed on a cost-plus-fee basis, management may be tempted to overcharge the cost of the job.

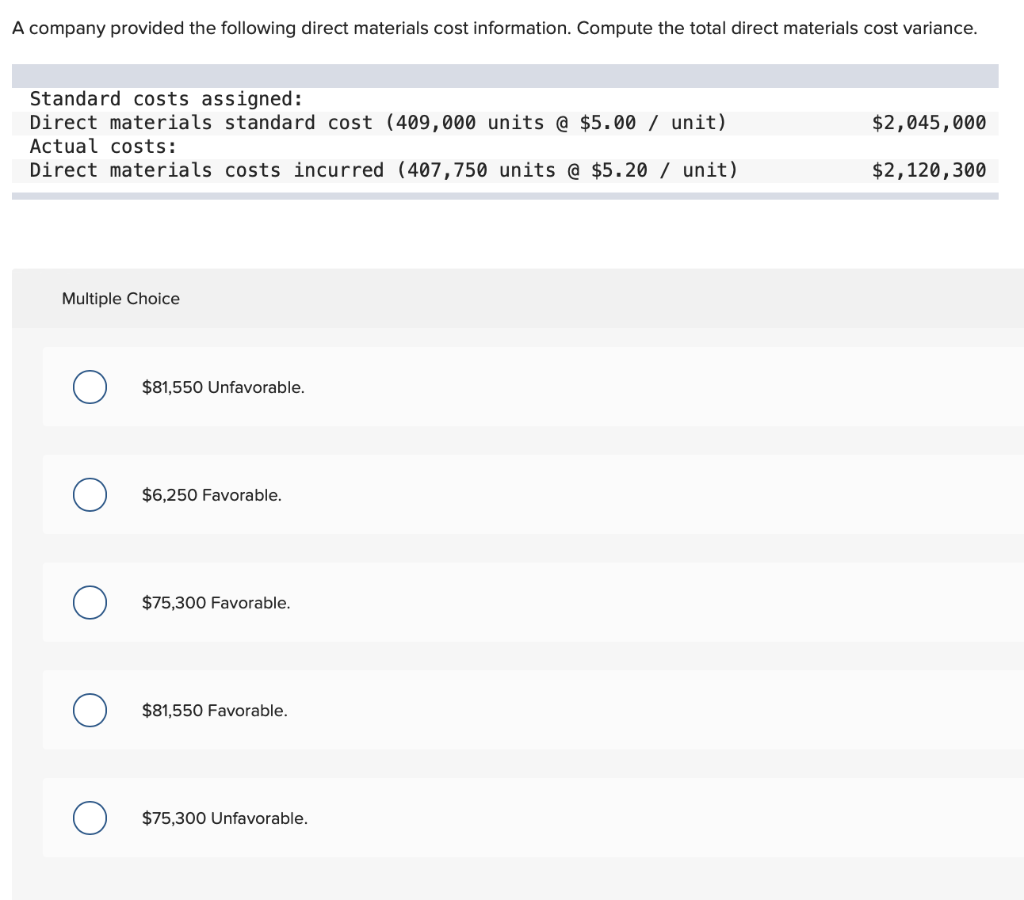

Further, a company needs raw materials on hand for future jobs as well as for the current job. The materials are sent to the production department as it is needed for production of the products. The materials price variance of $ 6,000 is considered favorable since the materials were acquired for a price less than the standard price.

2 Describe and Identify the Three Major Components of Product Costs under Job Order Costing

It should also be safe to assume that the more pies made, the greater the number of labor hours experienced (also assuming that direct labor has not been replaced with a greater amount of automation). We assume, in this case, that one of the marketing advantages that the bakery advertises is 100% handmade pastries. When Dinosaur Vinyl requests materials to complete Job MAC001, the materials are moved from raw materials inventory to work in process inventory. We will use the beginning inventory balances in the accounts that were provided earlier in the example. The requisition is recorded on the job cost sheet along with the cost of the materials transferred. The costs assigned to job MAC001 are $300 in vinyl, $100 in black ink, $60 in red ink, and $60 in gold ink.

Accounting for Manufacturing Overhead

The typical billboard sign is 14 feet high by 48 feet wide, and Dinosaur Vinyl incurs a vinyl cost of $300 per billboard. Direct materials are those materials that can be directly traced to the manufacturing of the product. Some examples of direct materials for different which department is often responsible for the price paid for direct materials industries are shown in Table 4.2. In order to respond quickly to production needs, companies need raw materials inventory on hand. While production volume might change, management does not want to stop production to wait for raw materials to be delivered.

We present additional data regarding the production activities of the company as needed. The beginning balances and purchases in each of these accounts are illustrated in Figure 4.8.

For balance sheet purpose, the direct materials is classified as current asset and is reported at its cost. The cost of direct materials purchased consists of price paid to supplier (including sales taxes) plus duties and shipment cost. The quantity of materials left unused in the stock at the end of an accounting period is presented in balance sheet as a line item named “Raw Materials Inventory”. The cost of such materials is directly traceable to each individual unit of product manufactured and is, therefore, regarded as direct or product cost. The quantity of direct materials needed to make a unit of product is usually known or can be closely estimated. For example, an engineer working in a furniture manufacturing company can easily tell you the quantity of wood, glue, nails and length of glass sheet needed to manufacture an executive table.

Just as a company provides financial statement information to external stakeholders for decision-making, they must provide costing information to internal managerial decision makers. To account for these and inform managers making decisions, the costs are tracked in a cost accounting system. Labor efficiency variance Usually, the company’s engineering department sets the standard amount of direct labor-hours needed to complete a product. Engineers may base the direct labor-hours standard on time and motion studies or on bargaining with the employees’ union.

The direct materials often form a major element of total prime cost of a given manufacturing process. It is important to understand that the allocation of costs may vary from company to company. What may be a direct labor cost for one company may be an indirect labor cost for another company or even for another department within the same company. If the employee’s work can be directly tied to the product, it is direct labor. If it is tied to the marketing department, it is a sales and administrative expense, and not included in the cost of the product.